nh meals tax calculator

Meals Tax at 7834 Multiply Line 3 by 07834 4 5. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

New Hampshire Sales Tax Rate 2022

This tax is only paid on income from these sources that is 2400.

. New Hampshire is one of the few states with no statewide sales tax. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

A calculator to quickly and easily determine the tip sales tax and other details for a bill. The Meals and Rentals MR Tax was enacted in 1967. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor.

The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase to 0 over. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. E-file fees do not apply to NY state returns.

New hampshire meals and rooms tax rate drops beginning friday. No state-level payroll tax. Our calculator has recently been updated to include both the latest.

Your household income location filing status and number of personal. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. A 9 tax is also assessed on motor.

If you have a substantive question. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ethan Dewitt-New Hampshire Bulletin.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. New Hampshire tax year. Exact tax amount may vary for different items.

New Hampshire does not have any state income tax on wages. Starting october 1 the tax rate for the meals and rooms. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year.

State e-file not available in NH. You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

2022 New Hampshire state sales tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for.

Meals paid for with food stampscoupons. If you earn normal wage there is no income tax. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

Additional details on opening forms can be found here. Can claim state exemptions. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Meals and Rooms Operators. Some schools and students. The current tax on nh rooms and meals is currently 9.

Please mail TAX PAYMENTS ONLY to the following address. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

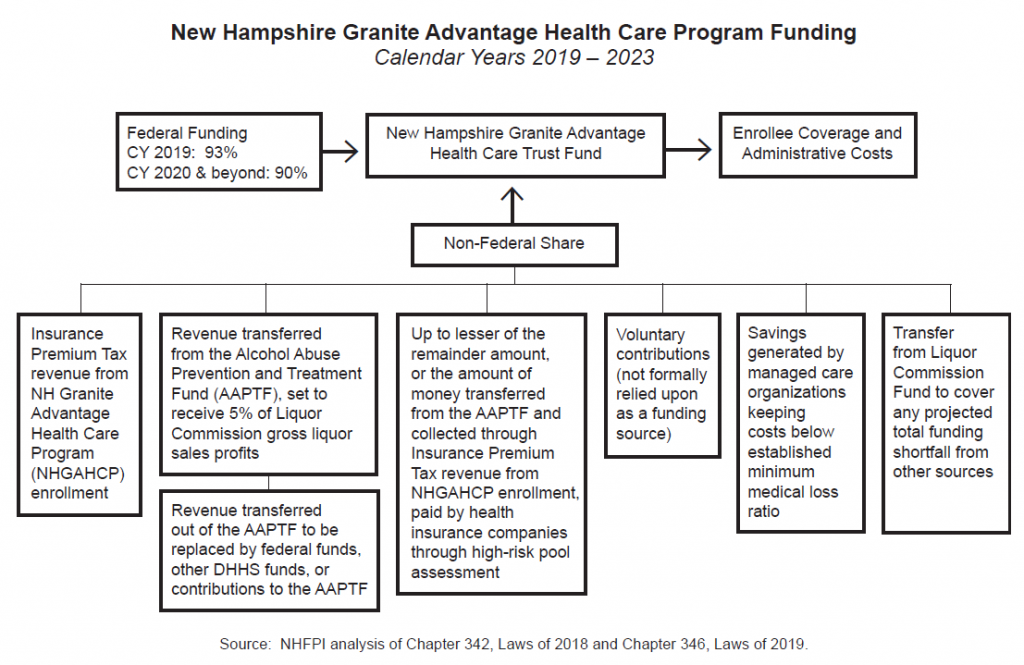

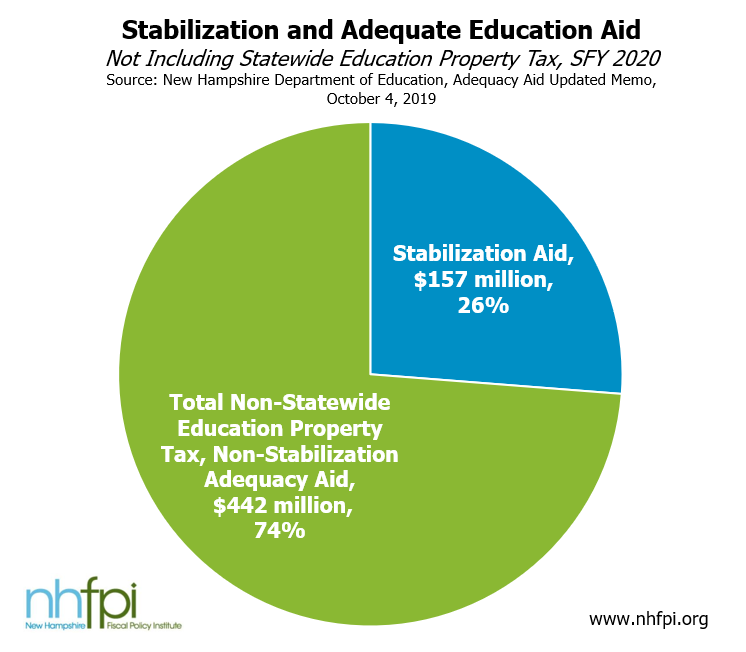

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

These Are The 10 Best Places To Live In New Hampshire

Summerfest Town Of Stratham Nh

New Hampshire Income Tax Nh State Tax Calculator Community Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Stratham Summer Fest 2022 Town Of Stratham Nh

Great Bay Food Truck Festival Town Of Stratham Nh

Business Nh Magazine State Tax Rules For Covid 19 Financial Relief

Parks Recreation News Announcements Town Of Stratham Nh

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

Tax Season 2022 H R Block Newsroom

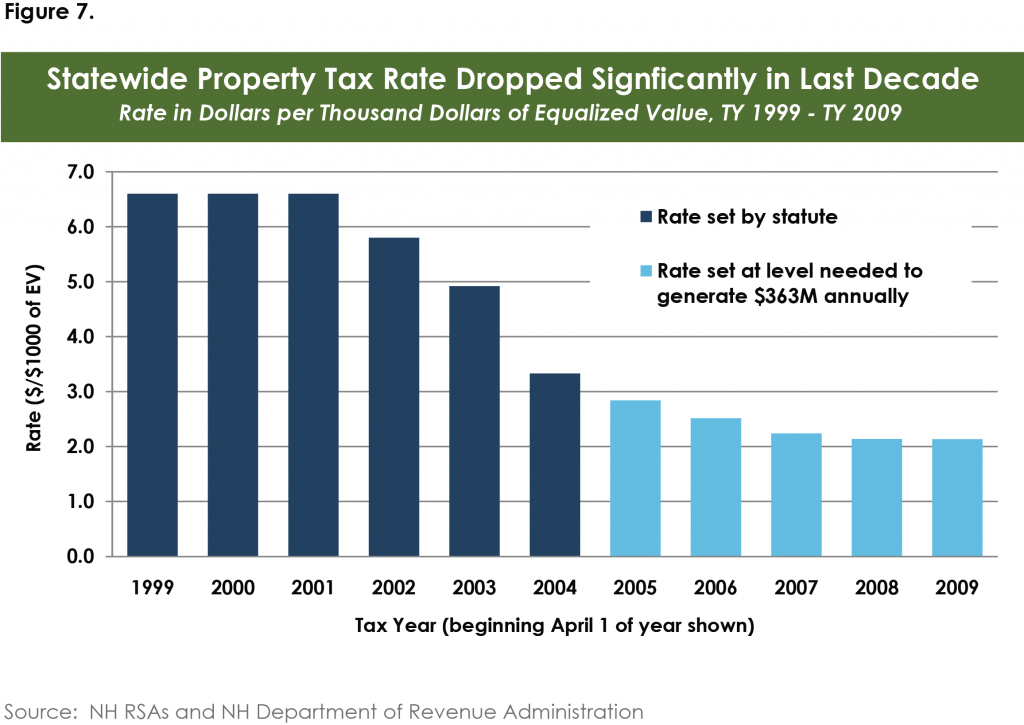

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Should You Move To A State With No Income Tax Forbes Advisor